Utilize that has a co-signer. Adding a creditworthy co-signer for your software will help you get authorised and accessibility superior interest charges. Keep in mind that your co-signer will grow to be Similarly to blame for the loan and skipped payments will destruction their credit history.

Caret Down All those who have thin credit history background or a fewer-than-stellar credit history score. Upstart has no bare minimum credit history score needs, and it evaluates more than just credit score for acceptance.

Required minimal distributions (RMDs) will be the bare minimum amounts you should withdraw from the retirement accounts each and every year.

Shop at the least a few distinctive lenders: Get prequalified with at least three lenders and Look at their premiums, phrases and any fees. It is possible to Pick from banking institutions, credit score unions or on-line lenders.

Because personalized loan prices are tied additional closely to temporary rates, You will find a probability they’ll drop when the Fed lowers premiums. That can signify lessen rates and monthly payments for individuals hoping to borrow cash this calendar year.

Have your primary monetary data — like your credit history rating — at the highest of one's mind while you skim with the details to make sure you qualify for the most beneficial costs.

Although I commonly advocate HELOCs since they offer decreased fees and a lot more flexible payment options than particular loans, private loans have some distinct pros in specified situations. I’d counsel homeowners intending to offer their properties within the spring avoid tying up their fairness by using a HELOC, especially if they need the cash from their sale for your down payment on a new household.

If you took out a personal loan to cover crisis charges, take into account instantly depositing cash into an emergency price savings account. Like that you’ll have cash to purchase urgent problems, rather than resorting to borrowing.

Bankrate’s editorial group click here writes on behalf of YOU – the reader. Our purpose will be to provde the very best suggestions that may help you make clever own finance conclusions. We follow strict recommendations to make certain that our editorial articles is just not affected by advertisers.

Why you may have faith in Forbes Advisor: Our editors are devoted to bringing you impartial rankings and information. Our editorial information just isn't influenced by advertisers.

There are many house loan choices available to retirees or seniors — generally similar to for anybody, with a person exception. Here are 7 to take into account:

A personal loan is usually a form of installment loan. You receive the money all at once and repay them in regular installments, much like a car loan or dwelling house loan.

IRA rollovers are prevalent. For instance, you could possibly shut out one retirement account and roll your funds straight into a new one particular with lower charges or far better provider. Your money is rolled more than from a single account on to Yet another.

Credit score software – A request for credit presented in writing. Occasionally an application cost will likely be billed to be able to address the price of processing the loan.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Jenna Von Oy Then & Now!

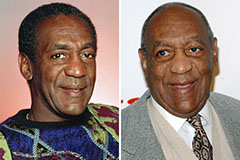

Jenna Von Oy Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!